This course is designed for professionals and those pursing a career in the following finance careers:

Our instructors are former I-bankers who give lessons real-world context by connecting it to their experience on the desk.

This is the same comprehensive course our corporate clients use to prepare their analysts and associates.

Save loads of time by bumping up playback speed to breeze through lessons at your own pace.

Have a question on course content? Communicate directly with instructors by asking questions throughout the course.

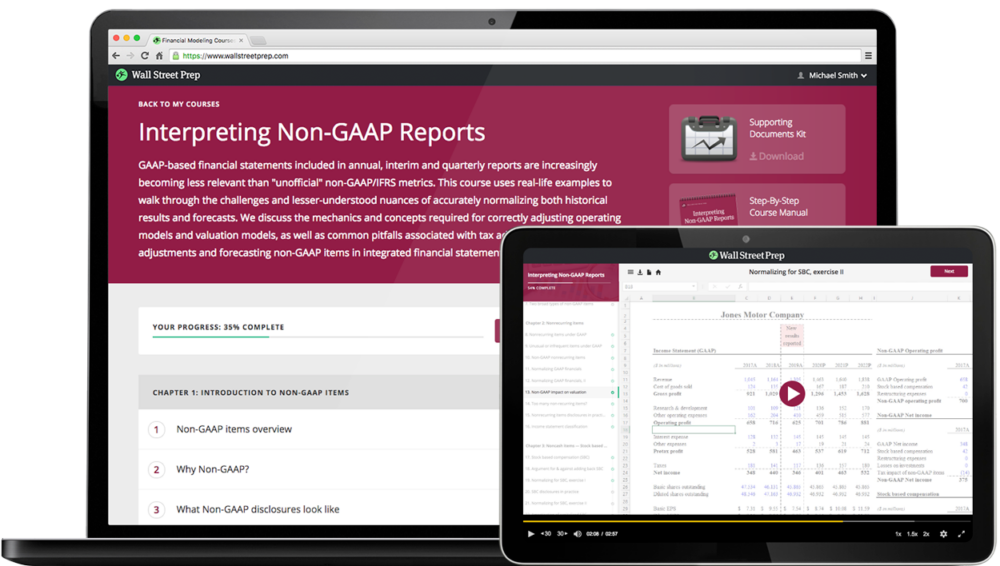

The program assumes a basic introductory knowledge of accounting (e.g. interaction of balance sheet, cash flow, and income statement) and proficiency in Excel. Students with no prior background in Accounting should enroll in the Accounting Crash Course. Students with limited experience using Excel should enroll in the Excel Crash Course.

There are no reviews yet.

You must be <a href="https://wislibrary.net/my-account/">logged in</a> to post a review.