This self-paced EMC certification program prepares trainees with the skills they need to succeed as an Equities Markets Trader on either the Buy Side or Sell Side.

While other Equities Markets courses add formulas and complexity to hide the lack of real-world experience, Wall Street Prep’s Equities Markets Certification was created by former sales and trading professionals focused on what interns, new hires, and early career analysts need to know on the job.

Designed following extensive discussion with hiring managers at major investment banks, we built our Equities Markets program around gaining the practical knowledge needed of growing markets such as ETFs, Delta One and Prime Brokerage.

Master how to use the Bloomberg terminal to analyze financial statements, find consensus EPS and monitor short interest.

Designed with input from the largest global investment banks on what Equities Markets salespeople and traders need to know.

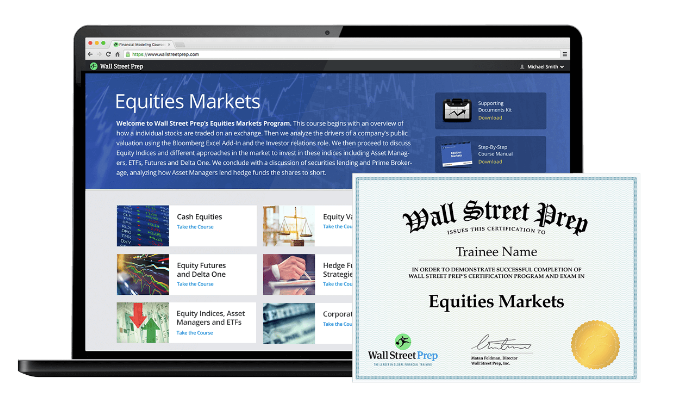

Graduates will receive a blockchain-verified, shareable certification that can easily be added to LinkedIn and resumes.

This course is career-focused. We begin with an overview of how a individual stocks are traded on an exchange. Then we analyze the drivers of a company’s public valuation using the Bloomberg Excel Add-In and the investor relations role; proceed to discuss equity indices and different approaches in the market to invest in these indices including asset managers, ETFs, futures and Delta One; and conclude with a discussion of securities lending and prime brokerage, analyzing how asset managers lend hedge funds the shares to short.

Equities Markets learners are eligible to earn Wall Street Prep’s globally recognized Fixed Income Markets Certification (EMC©). The certification is earned by successfully completing the final exam from each of the program’s individual courses. These online assessments can be taken any time after enrollment in the program.

![]()

MEET YOUR INSTRUCTOR

Eric is the lead instructor for Wall Street Prep’s Capital Markets and Sales & Trading programs. Eric’s financial markets career began after he was a finalist for J.P. Morgan’s Fantasy Futures trading competition. Eric worked at J.P. Morgan for 10 years across DCM, Syndicate and Sales & Trading Roles, including in the Cross Asset Sales & Structuring group with trade execution experience across all asset classes. Eric is an expert in International Markets and Cross-Border transactions with global work experience in New York, London, Hong Kong and Tokyo.

There are no reviews yet.

You must be <a href="https://wislibrary.net/my-account/">logged in</a> to post a review.