Our globally recognized fixed income certification program prepares you with the skills you need to succeed as a fixed income trader on both the buy side or sell side

While other Fixed Income courses add formulas and complexity to hide the lack of real-world experience, Wall Street Prep’s Fixed Income Markets Certification was created by former sales and trading professionals focused on what interns, new hires and early career analysts need to know on the job.

Designed following extensive discussion with hiring managers at major investment banks, we built our Fixed Income program around practical requirements like Bloomberg, with Excel exercises to demystify how Bloomberg calculates Yield and Duration on a bond.

Acquire expertise taught from an insider’s perspective. Master how to use the Bloomberg terminal to analyze bonds, yields and cashflows.

Designed with input from the largest global investment banks on what Fixed Income salespeople and traders need to know.

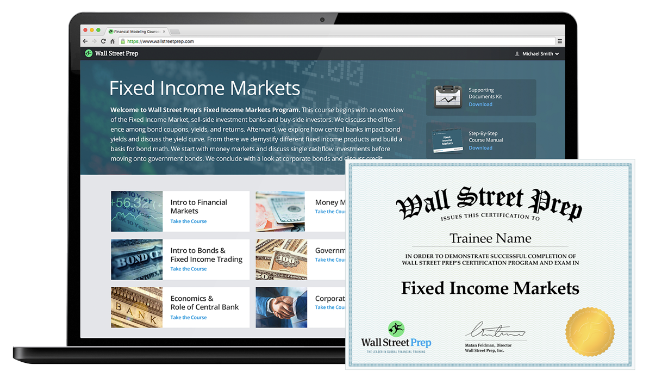

Graduates will receive a blockchain-verified, shareable certification that can easily be added to LinkedIn and resumes.

This fixed income markets certification course is career-focused. We begin with an overview of the Fixed Income Market, sell-side investment banks and buy-side investors; move on to exploring how central banks impact bond yields; and discuss the yield curve. We demystify different fixed income products and build a basis for bond math. Using money markets, we learn about single cashflow investments and government bonds. Finally, we look at corporate bonds, discuss credit analysis, and take a look at the impact of seniority and collateral.

There are no reviews yet.

You must be <a href="https://wislibrary.net/my-account/">logged in</a> to post a review.