Before vs. After the Robuxio Course

Before the Robuxio Course

- You rely on gut feel or loosely defined setups and every trade feels discretionary.

- Drawdowns shake your confidence because there’s no statistical baseline.

- Market moves feel random and you lack trust in your entries and exits.

- Wins are hard to replicate. Losses leave no clear diagnosis. Leaving you lost and confused.

- You spend hours analysing markets and are constantly glued to charts, without any increase in conviction.

- You overfit with too many indicators, yet trust none of them.

- You lack a scalable framework that you can trust with real capital.

After the Robuxio Course

- You operate a systematic process with defined rules and position sizing.

- Each trade is part of a strategy that is built on a robust idea-first logic.

- You understand your edge, your risk, and your drawdown profile.

- You make data-driven decisions and trust your execution, with no guesswork.

- You know exactly when to enter and exit, with a clear understanding of what logic your strategies were built upon.

- Your entire trading process is automated with zero discretionary decision-making

- You have a clear, validated plan with strategies you built yourself.

What You Will Master

1. Algorithmic Trading Edge Fundamentals

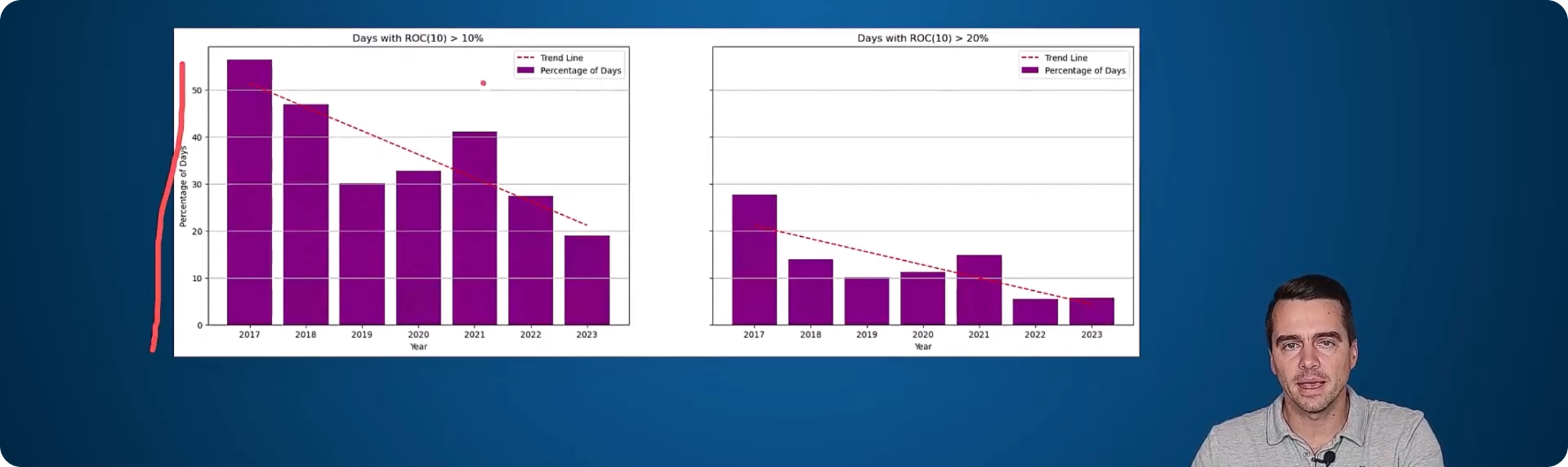

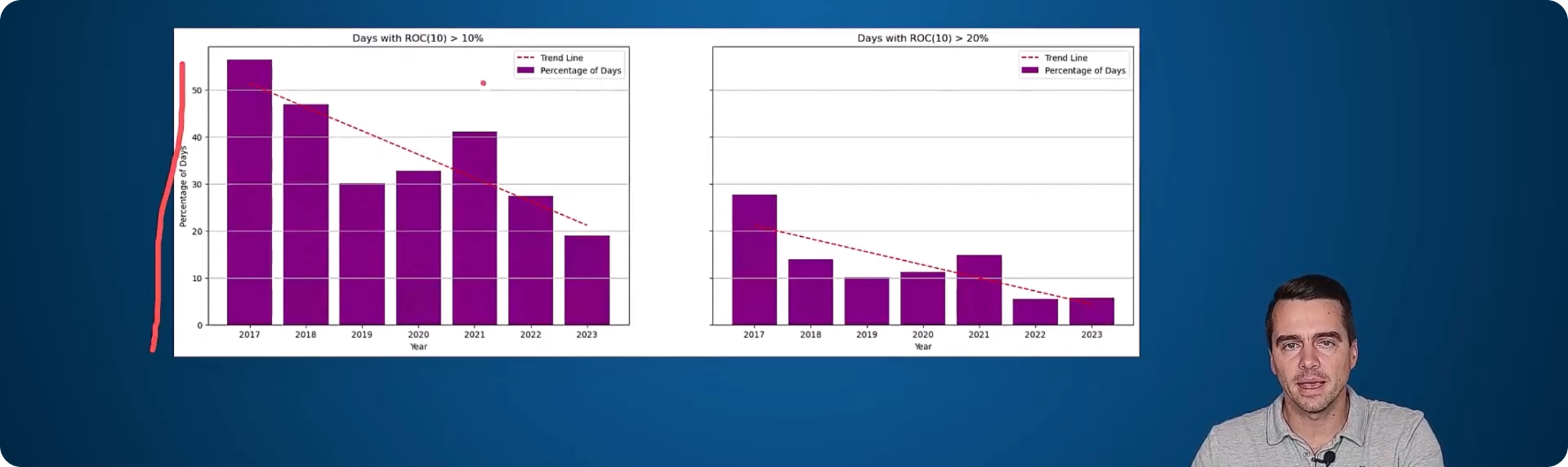

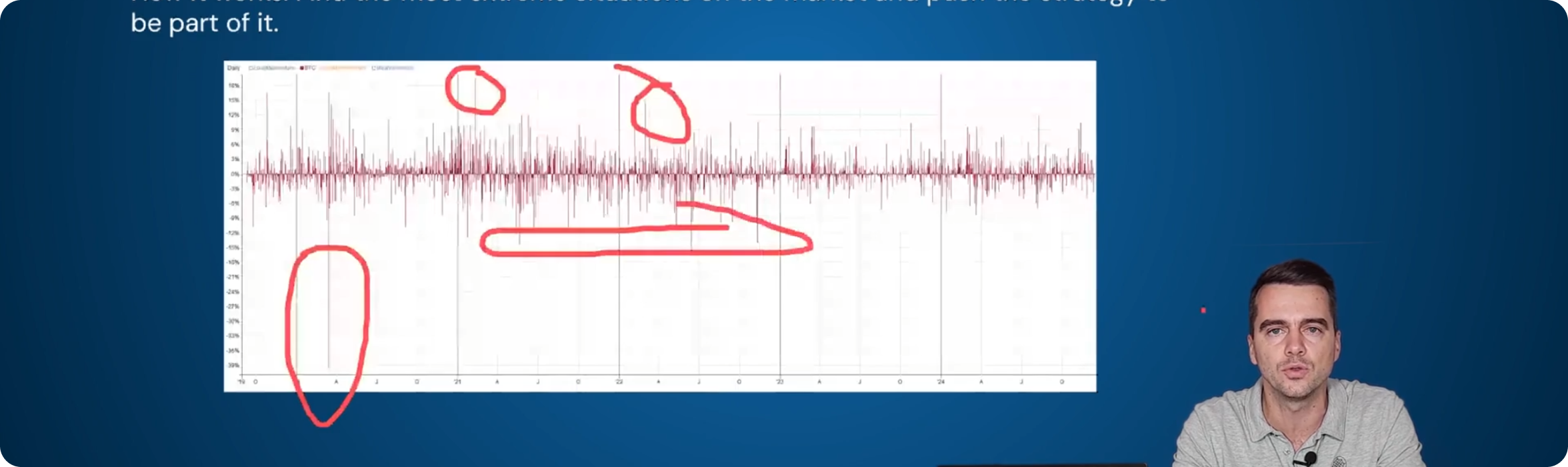

- Start matching strategies to the behavior of the assets.

- Focus on high-probability, data-driven approaches.

2. Foundational Strategy Types

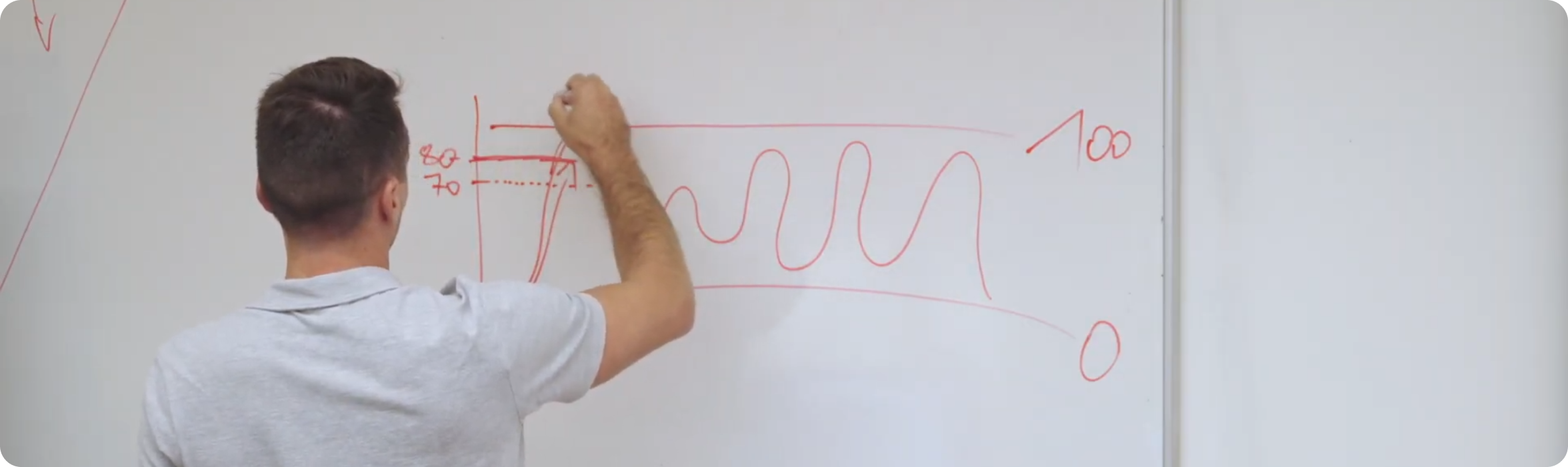

- Learn Breakout, Trend Following, Mean Reversion.

- Develop idea-first strategies with clear logic and edge.

3. Code and Data Analysis

- Get clean futures data of the entire crypto market.

- Get code templates with comprehensive explanations of each line.

- No programming knowledge required to implement and use.

4. Strategy Design & Execution

- Get access to 8 pre-built strategies.

- Learn to develop and refine additional strategies.

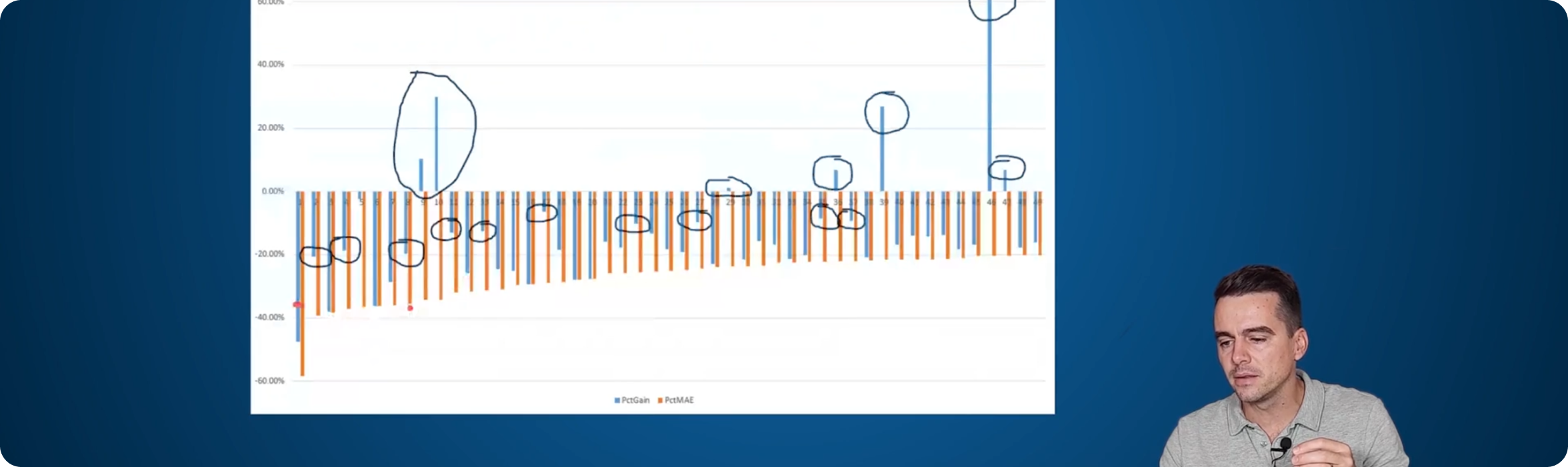

- Learn advanced exit techniques informed by data-driven insights.

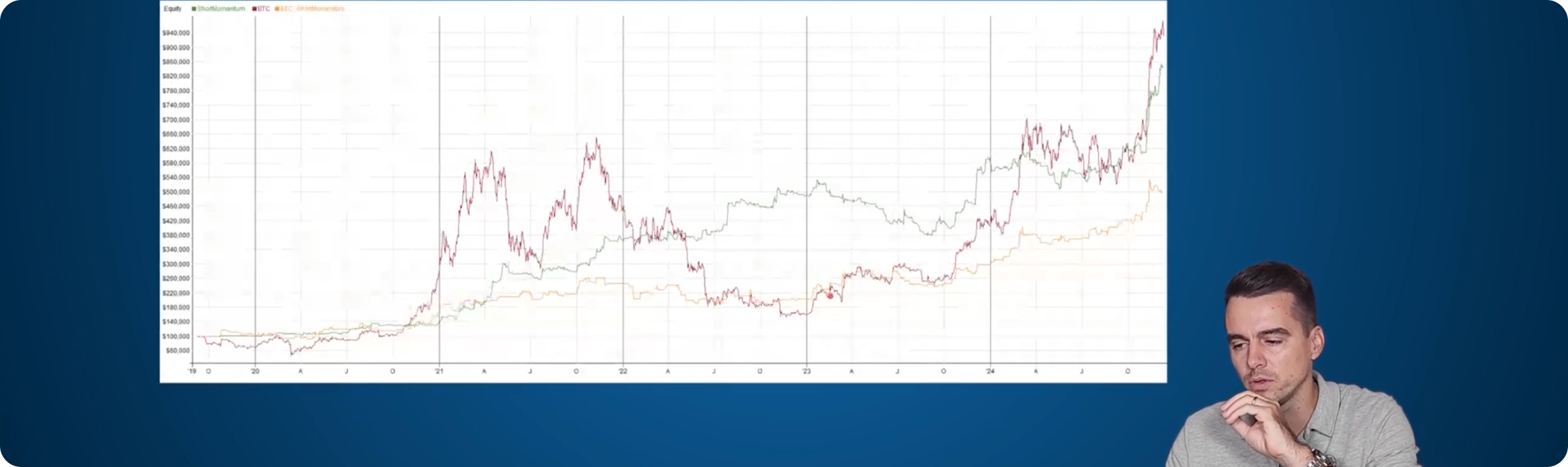

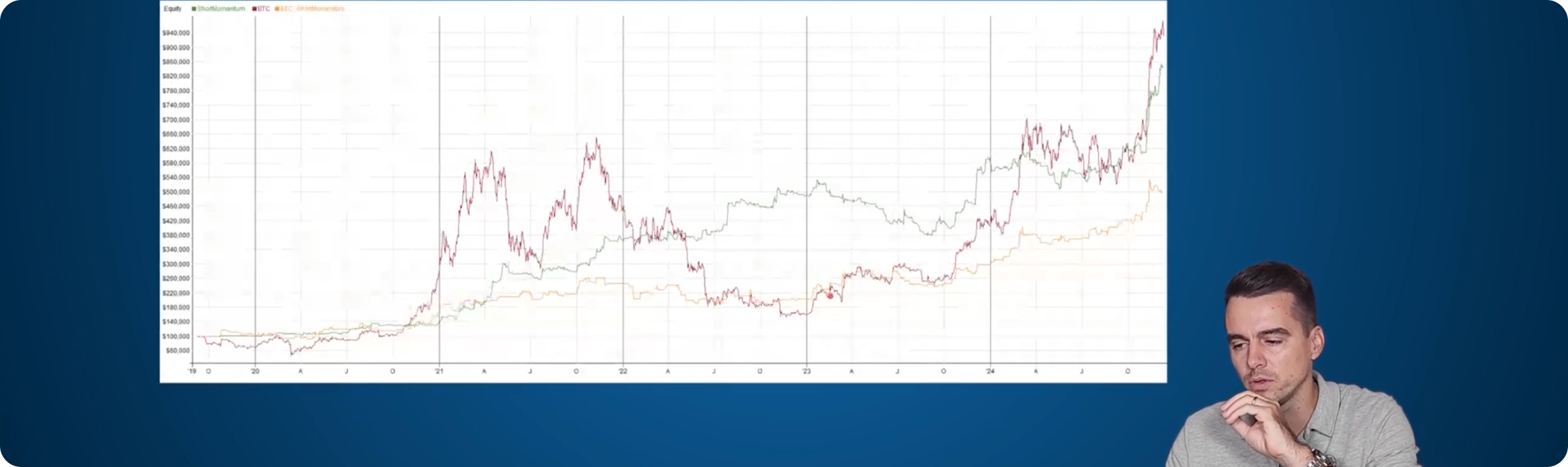

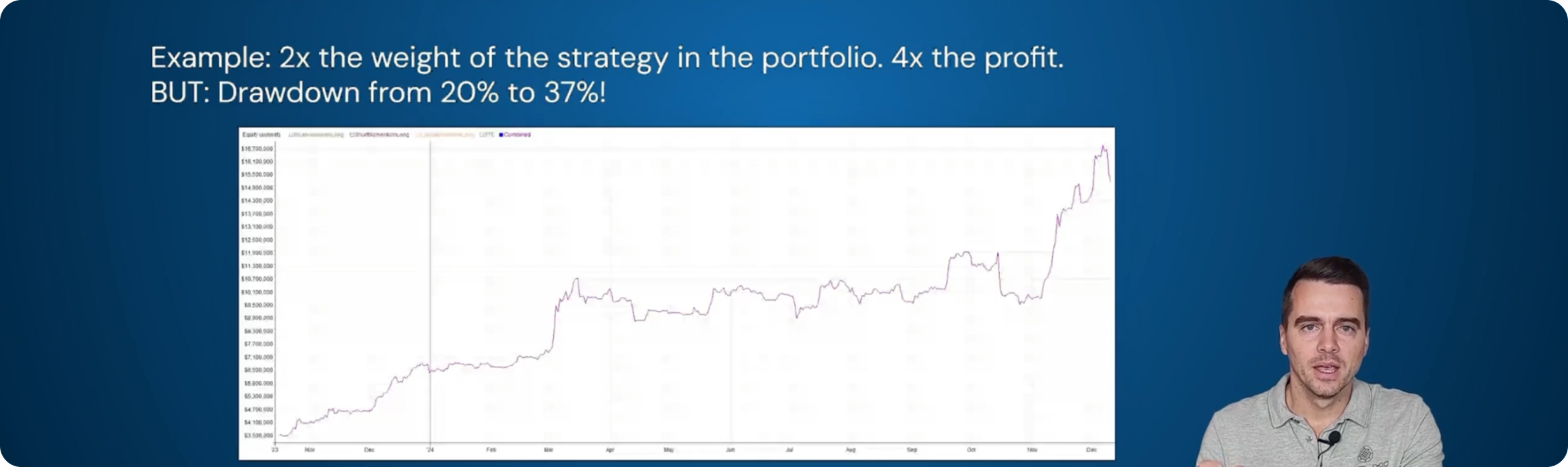

5. Robust Portfolio Development

- Construct scalable multi-strategy portfolios.

- Learn the link between uncorrelated strategies and portfolio design.

6. Trading Automation

- Get exclusive access to Robuxio Lite portfolio for 1 year.

- Trade it automatically with our trading engine.

- Choose between 3 different volatility levels.

Algorithmic Crypto Trading

Course Outline

Lesson 01: Introduction to Algorithmic Trading

Description:

This lesson focuses on the main criteria for selecting a proper backtesting platform. We dive into the basics of Realtest—our backtester of choice—learning how to import data and create a benchmark strategy.

Topic:

- Factors to Consider When Choosing a Trading Platform

- Key Features for Algo Trading

- Commonly Used Platforms

- Why Realtest?

- Example of Realtest Language

- Realtest: Source of Information

- Testable Trading Approaches

- Research-Driven Models

- Testable Data

- Code: Bitcoin Benchmark Strategy

Lesson 02: Backtesting Platform

Description:

This lesson focuses on the main criteria for selecting a proper backtesting platform. We dive into the basics of Realtest—our backtester of choice—learning how to import data and create a benchmark strategy.

Topic:

- Factors to Consider When Choosing a Trading Platform

- Key Features for Algo Trading

- Commonly Used Platforms

- Why Realtest?

- Example of Realtest Language

- Realtest: Source of Information

- Testable Trading Approaches

- Research-Driven Models

- Testable Data

- Bitcoin Benchmark Strategy

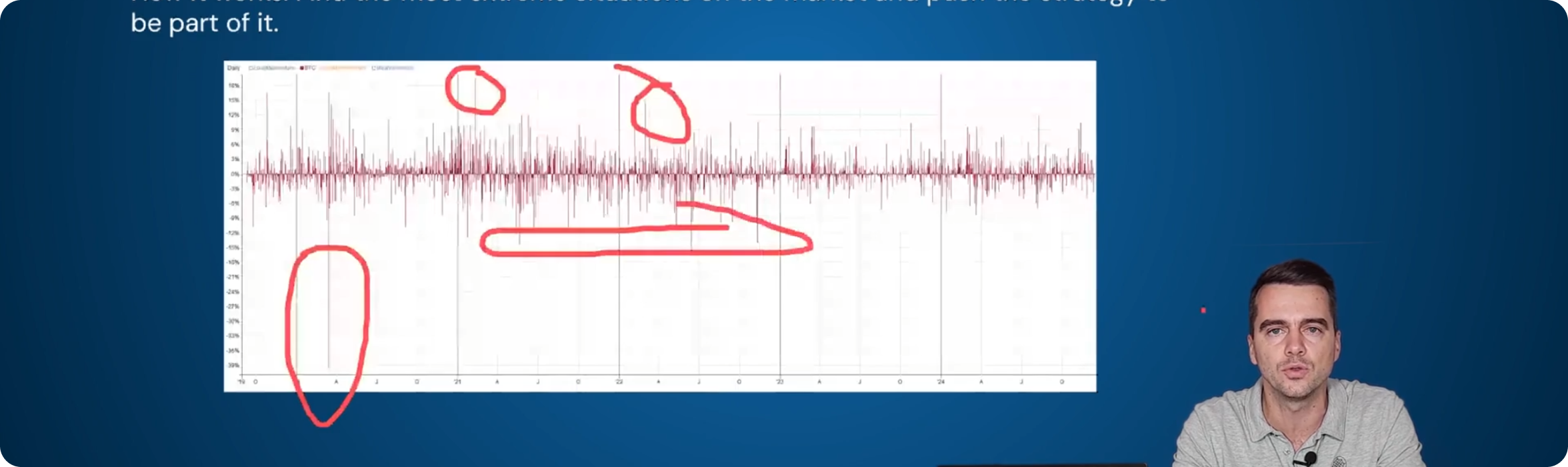

Lesson 03: Market Selection

Lesson 04: Trading Approaches

Lesson 05: Strategy Building

Lesson 06: Robustness Tests + Trend Following

Lesson 07: Exits

Lesson 08: Risk Management + RSI Strategies

Lesson 09: Portfolio Trading

Lesson 10: Trading Psychology

About

Hi, I’m Pavel, Algorithmic Trader and CEO of Robuxio!

I have been trading for nearly 20 years, and at Robuxio, we trade crypto for institutional clients using fully automated algorithmic strategies with remarkable success.

But my journey wasn’t always smooth. In fact, the early years were filled with painful lessons.

The Painful Beginning

For the first 5+ years, I struggled and lost money consistently.

Why?

- I didn’t have a systematically tested and robust trading edge.

- I would discover an idea, trade it, and abandon it after a few losses.

- I had no confidence in my approach—because I didn’t truly understand what I was doing.

It took me a long time to realize that:

- 1. Each asset behaves differently.

- 2. There are only a few sound trading approaches, and each needs to be applied to the right type of asset.

The Turning Point.

I also subconsciously resisted algorithmic trading because I thought, “I’m not a programmer—I can’t do this.”

But when I finally embraced algorithmic trading, things changed.

It wasn’t easy—I learned everything the hard way, losing tens of thousands of dollars and wasting years with no progress.

Why I Created This Course.

I don’t want you to go through what I did.

This course was initially created for students at Bata University in Zlín, to teach them everything about algorithmic trading in just 10 lessons. No programming skills needed.

Start Mastering Algorithmic Crypto Trading Today

You must be <a href="https://wislibrary.net/my-account/">logged in</a> to post a review.