At completion, trainees will have developed a comprehensive REIT model from scratch

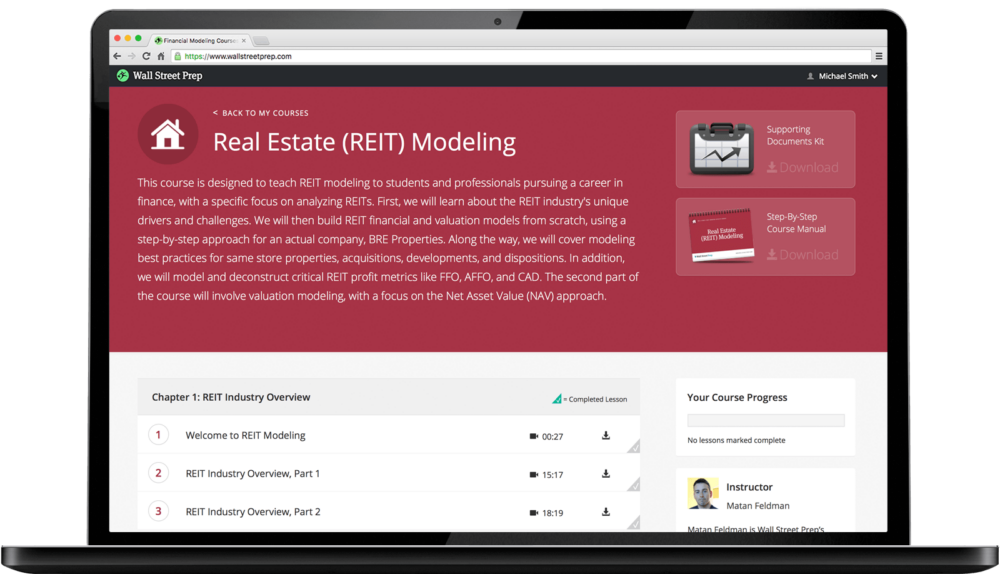

First, we will learn about the REIT industry’s unique drivers and challenges. We will then build REIT financial and valuation models from scratch, using a step-by-step approach for an actual company, BRE Properties. Along the way, we will cover real estate modeling best practices for same store properties, acquisitions, developments, and dispositions. In addition, we model and deconstruct critical REIT profit metrics like FFO, AFFO, and CAD. Part 2 dives into valuation modeling, with a focus on the Net Asset Value (NAV) approach.

Modeling the Income Statement, Part 1

Modeling CIP and Accum. Depreciation

REIT Operating Modeling Template

Wall Street Prep’s Real Estate (REIT) Modeling Course delivers step-by-step lessons through videos, readings, ready-to-use restructuring financial and valuation models and exercises using a real case study.

The Real Estate (REIT) Modeling Self Study program bridges the gap between academics and the real world and equips trainees with the practical financial skill set needed to succeed on the job. The program utilizes a case study format, as students follow their tutorial guide alongside the Excel model templates, and are directed to the appropriate external documents (SEC filings, research reports, etc.) in order to build complex Real Estate (REIT) models the way they would on the job.

Upon enrollment, students gain 24-month free access to Wall Street Prep’s Online Support Center, where they receive answers to questions, free downloads, and important updates.

This course does not assume a prior background in Real Estate (REIT) Modeling. However, those who enroll should have an introductory knowledge of accounting (e.g. interaction of balance sheet, cash flow, and income statement) and proficiency in Excel. Students with no prior background in Accounting should enroll in the Accounting Crash Course. Students with limited experience using Excel should enroll in the Excel Crash Course.

Chapter 1: REIT Industry Overview

Chapter 2: Modeling A REIT’s Income Statement

Chapter 3: Understanding & Modeling REIT’s Segments

Chapter 4: Ancillary Income & Non-Operating Items

Chapter 5: Understanding the REIT Balance Sheet

Chapter 6:Modeling the REIT Balance Sheet

Chapter 7: Cash Flow Statement & Model Cleanup

Chapter 8: The Revolver, Interest Expense & Circularity

Chapter 9: Modeling Future Developments

Chapter 10: Funds from Operations (FFO) & CAD

Chapter 11: REIT Valuation & the NAV Model

REIT Modeling Review

There are no reviews yet.

You must be <a href="https://wislibrary.net/my-account/">logged in</a> to post a review.